02/07/2022: Weekly Briefing

A few weeks ago I spoke with a veteran financial advisor who told me that her #1 financial advice for working adults was to call their HR to walk through all their benefits. She mentioned that a lot of times we don’t realize all the benefits that can come with employment and how important it is to maximize those benefits.

While I haven’t had a call with HR yet (on my to do list for this week), I did spend a fair bit of time going through my employer’s benefits website. One of the nuggets I found was that I get a free 30 min session with a financial advisor. So I scheduled that and spoke to that advisor earlier this week.

I walked him through my situation—recently bought a house for the first time, was employed, had some cash savings, multiple 401k accounts from previous employers, stock and ETF investments, and crypto investments. I also mentioned that I had these spread across many platforms.

He said that it was difficult to effectively manage a portfolio with so many platforms, because I can’t really get a good aggregate view of my investments. His #1 recommendation for me was to consolidate platforms/accounts.

So this is my homework this week. My first step was to actually count all of these…and I have 2 bank accounts, 4 401k accounts, 4 stock accounts, and 6 crypto accounts. Yikes!

I think the reason I have so many is that I’ve tried testing out different platforms, especially for work with Wallet Street. But it’s true that it’s become very unwieldy to have an effective view of my investments. For right now, I’ve been using a google sheet I made myself (template here) to aggregate everything, because I found that services like mint.com do a so so job. But even this approach hasn’t been super effective, so I’m going to take his advice and work on consolidation.

I’ll give everyone an update next week on how it goes… Wish me luck :)

Money & Crypto

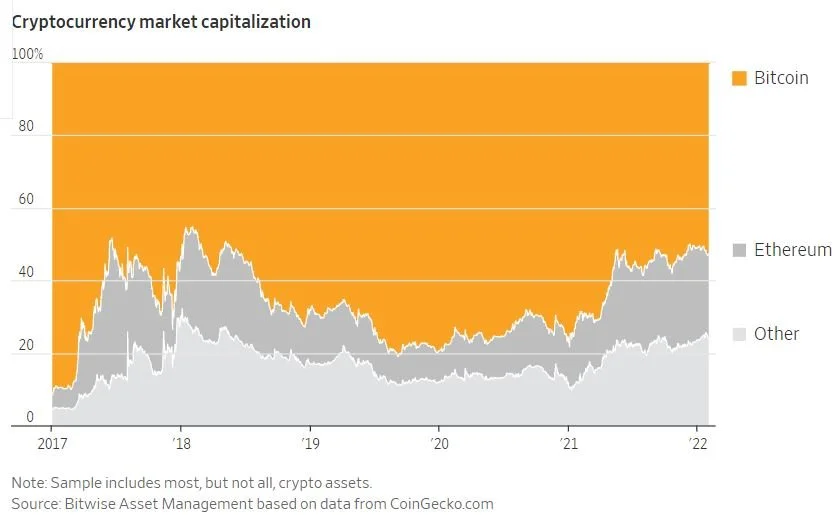

“You can get crypto right and still play it wrong” is a great piece about how to invest in crypto without putting your eggs all into one or a handful of currencies. This is something I’ve thought about lately because I tend to do this. However, some of the funds out there have some high fees…but maybe that’s worth it because you don’t have to actively managing owning a bunch of different crypto yourself? It’s something I’m exploring. (WSJ)

How Omicron is affecting companies because of being short staffed (WSJ)

Stock splits: What are they? How do they work? Why do companies do them? (Visual Capitalist)

UN report indicates North Korea using cryptocurrency cyberattacks to fund weapons/missile programs (BBC)

Bill being proposed in Congress to exempt capital gain taxes on deminimis crypto transactions. (The Block Crypto) Today, if you were to go buy a coffee with bitcoin, that would be considered a disposal or sale of bitcoin. Therefore, you would need to figure out what was the original price at with you bought that bitcoin, and then determine the price at which you sold that bitcoin, and pay taxes on that gain. This is not very efficient to do if you just want to buy a coffee.

This why this bill is being introduced. So that if you were to use bitcoin, or any other crypto to make a small transaction, and it resulted in less than a $200 gain, then you wouldn't need to pay taxes on it. It'll be interesting to see if this bill gets traction. The article states that there was a similar bill that tried to get through in 2020.

Etc.

Senegal defeats Egypt in Africa Cup of Nations (CNN)

Olympics have started! First US medal and the latest medal count

The politics of picking a meeting time (WSJ) (I would say that while I worked in investment banking, that solid 40% of my time was spent trying to find a meeting time that worked for all the senior managing directors… )

Charles McGee, Tuskegee Airman, passes away

Thích Nhất Hạnh, Buddhist monk and peace activist during the Vietnam war, passes away

Podcast Pick of the Week

🎧Teri Gross (of NPR’s Fresh Air) must be on a Succession binge or something…Fresh Air has recently interviewed Tom Wambsgans (aka Mr. Darcy aka Matthew Macfadyen), Roman Roy (aka Kieran Culkin), and the legend himself Logan Roy (aka Brian Cox).

Disclaimer: All opinions are my own. The content on this site and on the podcast does not constitute financial, legal, accounting, tax, or investment advice.