01/25/2021: Weekly Newsletter

First things first!: If you have been in news & social media hibernation the last week and have not yet seen Amanda Gorman’s reading of her poem “The Hill We Climb”, please go watch/read it and then come back and read the rest of the newsletter. I am willing to bet that no matter what your politics are, you will find it a worthwhile way to spend 5 minutes. Also, she has much more interesting things to say than this newsletter does.

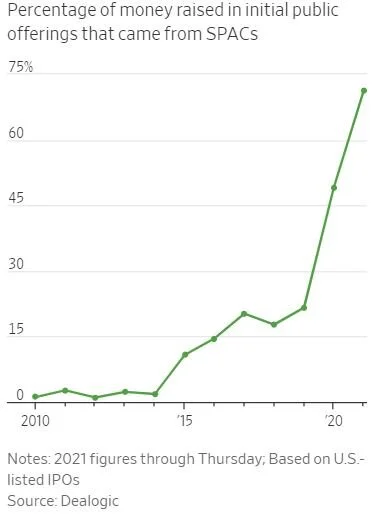

Turning to money stuff: Over the weekend, the WSJ had a great overview of how SPACs have taken over the finance industry in 2020. I still am kinda stunned at how these are doing are so well. For example, read some of the quotes from this article.

“SPACs have actually been around for deacdes. Their predecessors—known as “blind pools”—had a shady reputation on Wall Street in the 1980s because they were tied to penny-stock fraud.”

“What some don’t like is that SPACs and the mergers they produce are negotiated behind closed doors and prices are less dependent on real-time demand from investors.”

“DraftKings, an unprofitable sports-betting company that generated $292 million in revenue during the first nine months of 2020, merged with a blank-check firm in April 2020. It is now valued at $42 billion, making it roughly the same size as companies that churn profits such as Ford Motor Co. and Walgreens Boots Alliance Inc.”

After reading the above, I guess I don’t really understand why there aren’t more red flags being raised at these and why investors are such fans? I understand that it expedites the IPO proces—that a company can get listed publicly faster—but it seems that this benefit could potentially be outweighed by many ofther possible downsides…?

Money & Crypto

SPACs invading Wall Street and how banks made a lot of fees from them

BlackRock to add crypto to 2 funds

Most to least Bitcoin-y Bitcoin exposures by Matt Levine is delightful

Coinbase to offer private shares on secondary market

Ether reaches new all time high

Wingcopter, drone startup, raises Series A

Blobr, Paris-based startup selling APIs as products raises pre-seed

Tech

UK COVID strain could be more deadly

Google sunsets project Loon, balloons that brought web services to hard to reach places

Difference between current vs electric field vs voltage explained (While this did help me a little bit, I still don’t think I fully understand all the differences…lol)

Etc.

If you have ignored my earlier plea and still haven’t watched Amanda Gorman’s reading of her poem "The Hill We Climb”, I am asking you a second time to stop reading this newsletter and go read and/or listen to her poem instead. It is much more interesting than anything I have to say here! :)

The ‘Pizza Pusha’, the wild story of a man selling THC laced pizza in NYC

♫ Podcast “Winds of Change” is a highly addictive look at a CIA covert operation. If you’re into spy stuff and/or Cold War history, I’m only one episode in so far but definitely recommend!

♫ While it was not my own idea to start watching Cobra Kai (the Karate Kid tv-series spin off), I have become a not so unwilling viewer and the show has grown on me

Hank Aaron, baseball legend, passed away

Larry King, tv interviewer synonymous with CNN, passed away

Disclaimer: The content on this site does not constitute financial, legal, accounting, tax, or investment advice.